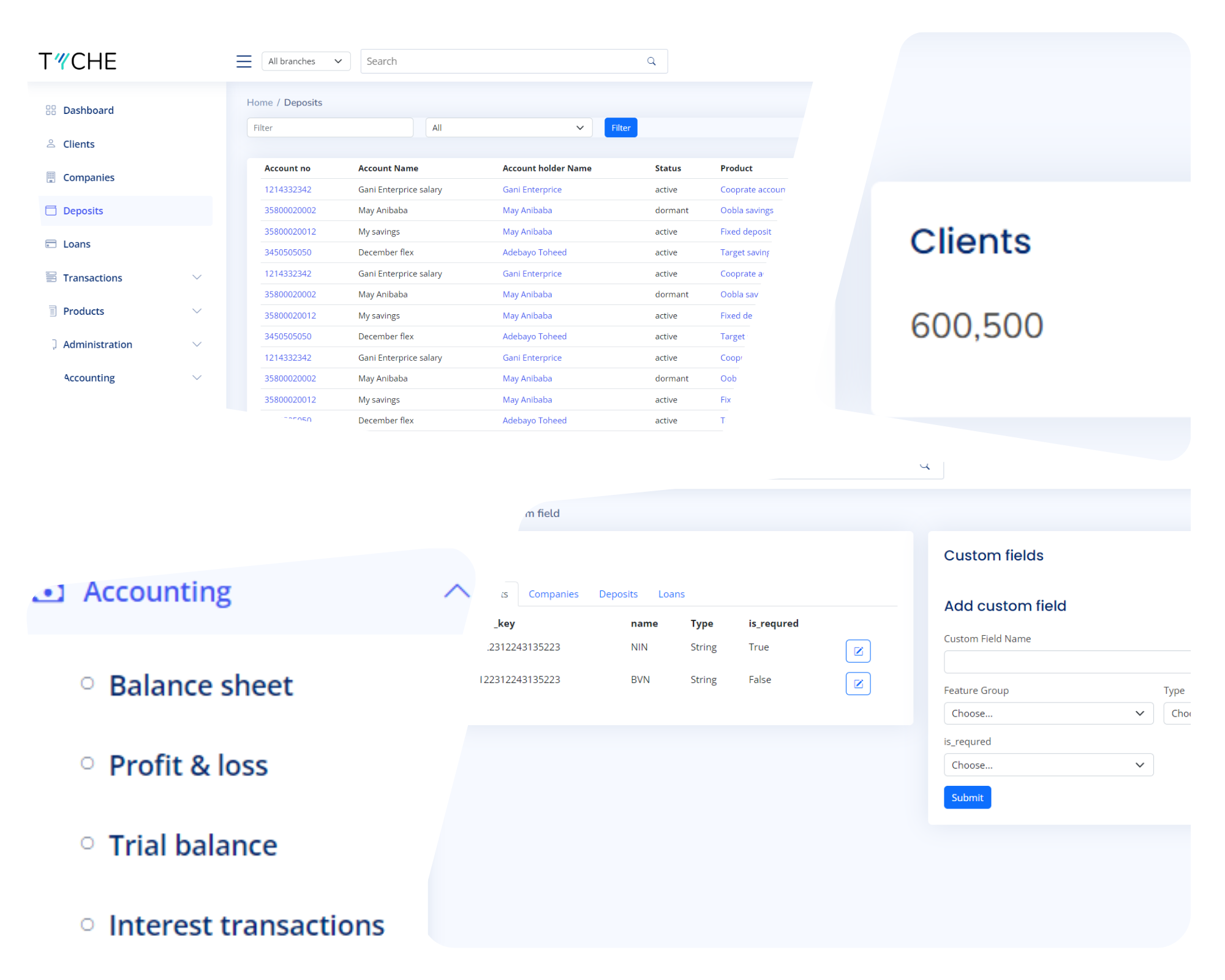

Cloud Core Banking

Nimble. Powerful. Customisable.

Tyche focuses on composable banking by recognizing the limitations of inflexible core banking systems. On a cloud-native engine, you can combine independent components and services to create custom lending and deposit solutions precisely when needed, whether you're building a new bank or transforming existing services into digital-first solutions.